Most retail traders enter the options market lured by the promise of quick riches.

The reality, however, is far from that. Trading is not a hobby—it is a business. And like any business, it requires structure, a well-defined strategy, and a repeatable process that generates consistent returns over time.

In the world of professional options trading, mastering income-generating strategies such as the Vertical Spreads, Iron Condor, Calendars, Debit Condor, Butterfly, Jade Lizard, Broken Wing Butterfly, etc. is not just advisable—it is imperative.

The Options Edge: A Business Model, Not a Gamble

Unlike directional stock traders who rely on market movements to generate profits, options traders have the ability to profit in different market conditions—bullish, bearish, or sideways. The key lies in adopting structured, risk-defined strategies that create repeatable income.

This is where multilegged options strategies such as condors and their variations come into play.

Condors, when implemented correctly, capitalize on range-bound movements, time decay, and volatility compression—factors that make them ideal for traders looking to build a sustainable income model rather than relying on speculative trades.

Traders who master these strategies transition from being mere market participants to running a disciplined trading business.

Why It’s Important to Learn These Strategies Properly

Many traders attempt to implement options strategies without fully understanding their mechanics, risk-reward profiles, and market conditions in which they work best. This often leads to costly mistakes, unnecessary losses, and frustration.

Learning these advance strategies properly is crucial because:

- Risk Management: Without a thorough understanding of condors and their variations, traders may expose themselves to unintended risks, such as sharp market moves that can quickly erode profits.

- Optimal Adjustments: Markets are dynamic, and being able to adjust positions when conditions change is critical to maintaining profitability.

- Maximizing Profit Potential: Knowing how to structure these trades correctly allows traders to optimize entry points, expiration cycles, and implied volatility edges.

- Emotional Discipline: Proper education helps traders develop the confidence needed to stick to their strategy rather than panic when market conditions shift.

Why Condor Variants Are Essential

The Iron Condor, Debit Condor, Butterfly, Jade Lizard, and Broken Wing Butterfly each offer distinct advantages. Mastering these strategies ensures that traders can adapt to different market environments, including periods of heightened volatility—such as the one we may experience under Trump 2.0.

The Iron Condor is a favorite among income traders because it allows them to profit when a stock or index remains within a defined range. By selling both a put spread and a call spread simultaneously, traders collect premium while defining their maximum risk.

This strategy thrives in low-volatility environments but can be adjusted dynamically to accommodate volatility spikes. Here is a standard risk / reward profile of an Iron Condor.

On the opposite spectrum of an Iron Condor is a debit condor which is useful when options traders anticipate a directional move. Unlike the Iron Condor, which is a credit spread strategy, the Debit Condor requires paying a net debit but offers limited risk and significant upside in the right conditions.

Option traders who understand how to balance debit and credit positions can maximize their returns while keeping risk under control.

The Jade Lizard is a lesser-known but highly effective income-generating strategy. It combines a short put with a call spread, generating a net credit while ensuring there is no risk to the upside. There are many ways options traders can structure a lizard trade.

This strategy can be particularly useful when volatility is high, providing an asymmetric reward structure with defined risk. Here is how a typical risk profile for this powerful options income strategy.

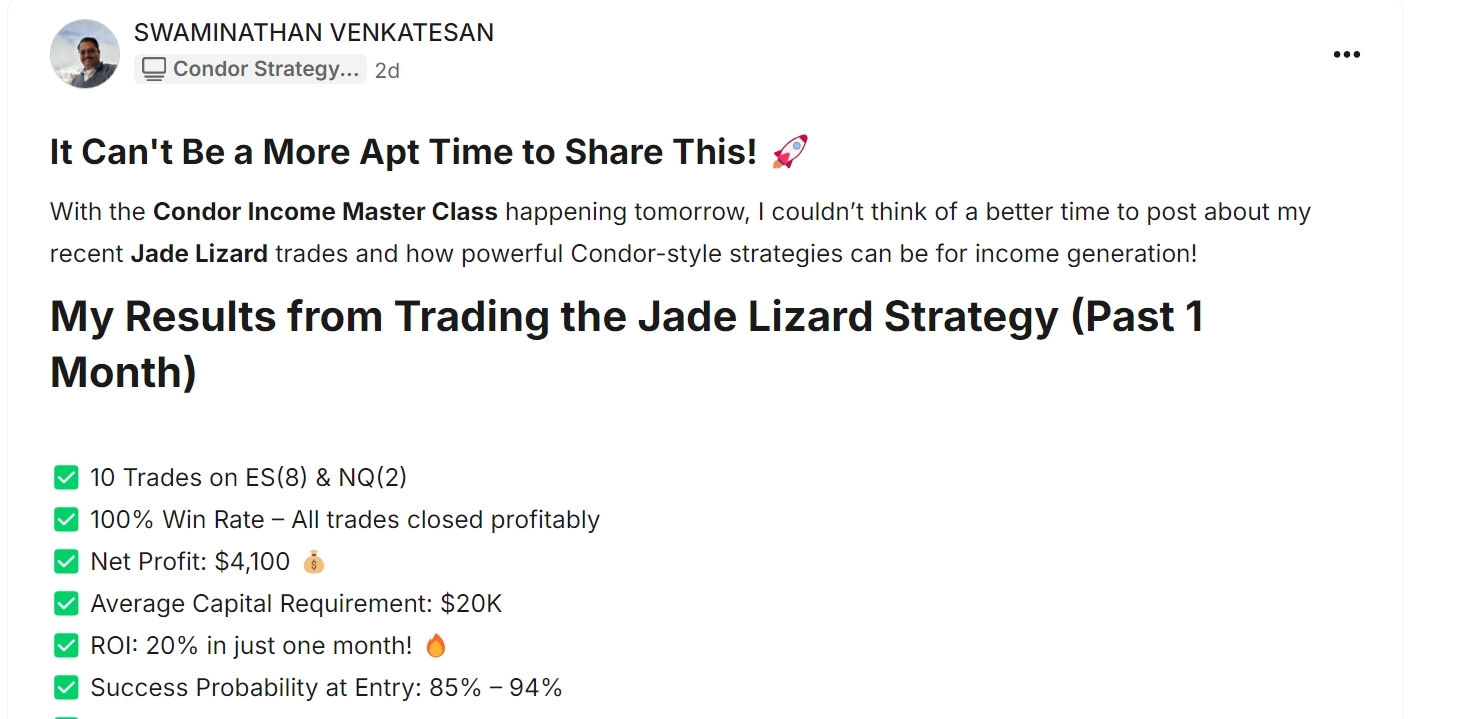

Once you learn the skills and proven systems to trade this properly, this powerful strategy can bring consistent cash flow into your options trading business. Just look at recent winning streak by Swaminathan, an OptionPundit student from Dubai:

The Butterfly spread, often used by professional options traders, is ideal for pinpointing price targets. It involves selling two at-the-money options while buying one in-the-money and one out-of-the-money option. This structure creates an excellent risk-reward profile when applied correctly, especially in range-bound markets.

Here is how the P&L looks for a standard butterfly option spread:

The butterfly spread can be transformed into a Broken Wing Butterfly (BWB) that adjusts the risk-reward ratio by moving one leg further out of the money. This allows traders to minimize risk while increasing potential profits. Unlike a traditional Butterfly, the BWB can be structured to have zero or limited downside risk while still benefiting from time decay and price stability. It is particularly useful in volatile markets where a full-risk Butterfly may not be ideal.

As you can see, there are many variations of these multilegged strategies. I just mentioned only a few as a start and I didn't even cover the calendars and diagonal yet. If you acquire these lifelong skills, learn under proper guidance, you will potentially have a very powerful options trading strategic toolbox containing strategies that you cand deploy according to prevailing market environments.

However, before you start embracing these options trading strategies, let me share some of the common mistakes that I observe options trader make time and again.

Common Mistakes & How to Avoid Them

Even experienced traders make mistakes when implementing income-generating strategies. Here are some of the biggest pitfalls and how to avoid them:

- Trading Without Proper Skills: This is the #1 mistake I see options traders make. Just because they know how to trade vertical spreads, they think they can trade these multilegged strategies easily. No, that's not true. You need to have a solid understanding of how these are structured properly and how Options Greeks behave in various market situations. Knowing how to adjust, repair and manage risk is much more important than simply building a trade.

- Over-Leveraging: This is another big mistake. Using too much capital on a single trade can be disastrous if the market moves unexpectedly. Keeping position sizes reasonable ensures longevity in trading.

- Ignoring Volatility: Not adjusting strategies for changing volatility conditions can lead to missed opportunities or unnecessary risk.

- Poor Exit Strategies: Many traders fail to lock in profits or cut losses at the right time. Pre-planned exit strategies help mitigate this issue.

- Not Having a Trading Plan: Trading without a structured plan often leads to impulsive decision-making. Establishing and sticking to a solid framework is critical for long-term success.

Volatility in the Age of Trump 2.0: Limitless Trading Opportunities

With the increasing possibility of a second Trump presidency, market participants are bracing for heightened volatility. Trade wars, economic policy shifts, and geopolitical uncertainty could drive the VIX to levels not seen since the pandemic era. For options traders, volatility is not an enemy—it is an opportunity.

Condor strategies, when deployed correctly, allow traders to harness volatility rather than fear it.

Here is an example how we made over +20% of the profit under few hours when markets experienced significant volatility before President Trump and President Zelensky met on 28 Feb'25.

When volatility is high, Iron Condors can be structured with wider wings to collect higher premiums. Butterflies can be placed at optimal price levels to benefit from volatility mean reversion. Debit Condors, Jade Lizards, and Broken Wing Butterflies offer alternative plays to take advantage of rapid option repricing.

At OptionPundit, we have consistently highlighted the importance of understanding volatility cycles and adapting income strategies accordingly. A trader who can master these techniques stands a far better chance of sustaining long-term profitability than one who merely reacts to market movements.

The Path to Mastery

Becoming proficient in these strategies requires a structured approach.

While trial and error can be a painful (and costly) teacher, a well-designed curriculum can significantly shorten the learning curve. That’s why experienced traders seek structured training programs that provide not just theoretical knowledge but also live market applications.

For those serious about building a trading business, mastering Condors and their variations is non-negotiable. The upcoming Condor Income Mastery Program is designed to equip traders with the tools necessary to navigate different market conditions, manage risk effectively, and establish a consistent income stream.

Join the Condor Income Mastery Program

If you're looking to take your options trading to the higher level, the Condor Income Mastery Program is your structured roadmap to success. This CIM Mastery program, over the course of 1 Year, provides in-depth training on multiple income strategies like Iron Condors, Butterflies, Jade Lizards, and Broken Wing Butterflies. You’ll gain hands-on experience, live trading examples, and the strategic insights needed to establish your options trading business. Whether you're a beginner or an experienced trader looking to refine your skills, this program is designed to fast-track your success in options trading.

Here is how real student feel once they are into the program:

Bottomline:

Trading options is not about chasing lottery-ticket trades.

It is about developing a systematic approach that treats the options trading as a business. Multilegged strategies strategies provide traders with a structured framework to generate steady returns while mitigating risk. With Trump 2.0 likely to introduce increased volatility during the next 4 years, understanding these strategies will be more critical (and potentially more profitable) than ever.

The time to master these strategies is now. If you want to trade better during Trump 2.0, enroll now. Our 2025 class begins on March 8, 2025. One year from now you don't wanna look back and say "Gosh, what was I thinking? Why was I so skeptical or unable to make that transformative decision. Wow, that was a great opportunity".

Time is now!

I look forward to seeing you inside the powerful condor mastery program.

Happy Trading,

Manoj Kumar

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.